Boost Your Cashflow and

Streamline Your Business

Welcome To Boxfi Payment Processing

Our payment processing consultation services can help save you money, increase profits, and secure the funding you need for expansion. Say goodbye to credit card fees and hello to financial peace of mind with BoxFi.

Boost You Cashflow and

Streamline Your Business

Welcome To Boxfi Payment Processing

Our payment processing consultation services can help save you money, increase profits, and secure the funding you need for expansion. Say goodbye to credit card fees and hello to financial peace of mind with BoxFi.

Discover How To Raise Your Bottom Line By Watching This Video

$0

Set Up Fees

99%

Cost Savings

100%

Customer Retention

$0

Set Up Fees

99%

Cost Savings

100%

Customer Retention

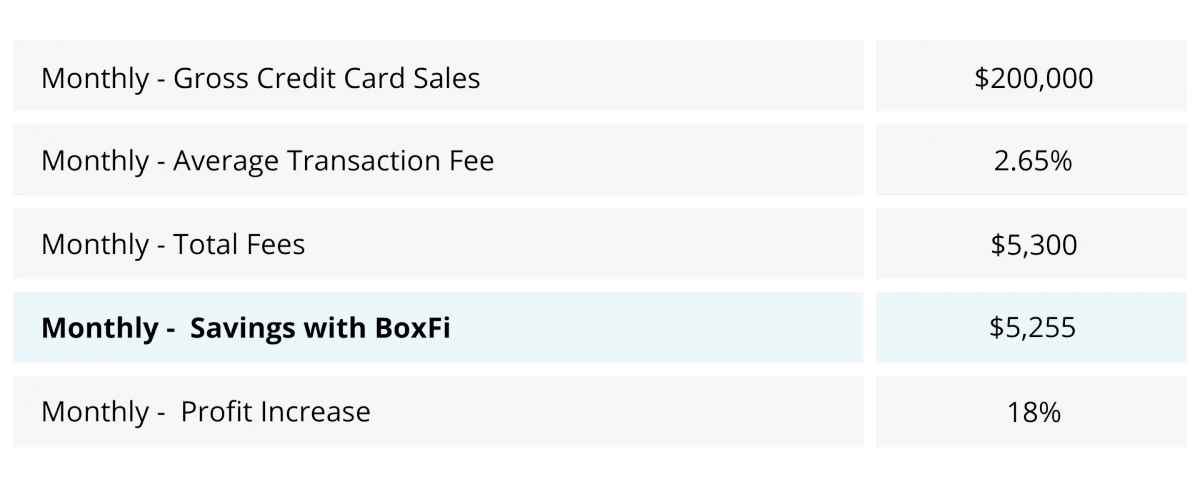

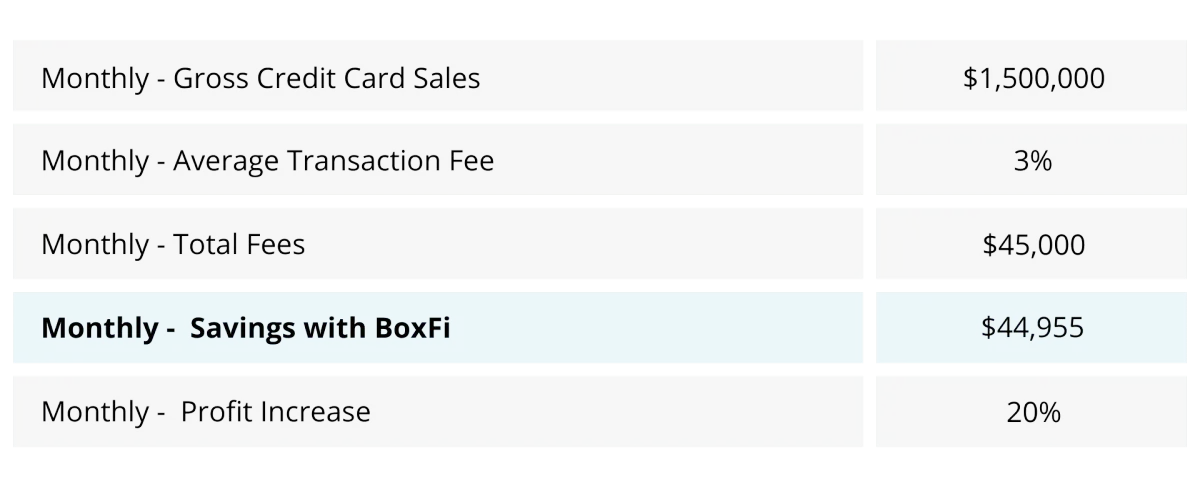

How Much Money Can You Save?

Use the tool below to calculate how much you can save

Your Average Monthly Credit Card Sales?

How Much Money Can You Save?

Use the tool below to calculate how much you can save

Your Average Monthly Credit Card Sales?

Now... You Can Offset the Cost of Payment Processing

How We Save You Money

CASE STUDY | RESTAURANT

CASE STUDY | CAR DEALERSHIP

As of 2021... over 81% of consumers in the US make the majority of their purchases with card vs. cash

BENEFITS OF WORKING WITH US

All of your processing fees are gone forever. You never have to pay a processing fee again.

It’s easy to switch! Whether you're an online business, or brick and mortar, our team will set you up with everything you need to make the transition seamless, so you can start saving.. today!

Your customers don’t have to pay processing fees unless they want to. If they decide the rewards on their card outweighs the cost of acceptance, they will pay with a card. If they want the cheapest price possible, paying with cash gives them what they want.

No hidden fees. You won’t find any surprising line items on your statement that hide fees you shouldn’t be paying. Your statement will read $0 at the end of every month while you accept every type of major card brand as payment for your business.

Free POS Payment systems are available! Based on your monthly volume and business type, we can provide you with a point of sale systems for your business free of charge!

THE PROBLEM | PROFIT MARGINS ARE SHRINKING

product offering isn’t best in class. Processing fees of 2.5% - 3.5% on average are further contributing to the shrinking margins.

Over 10.6 Million US Merchants Accept Credit Cards

On Average 15% Of Profits Are Lost To Transaction Fees

THE SOLUTION | TAKE YOUR PROFITS BACK

With all the market factors and problems with traditional solutions in mind, there is a simple way to win. Do it

differently. Most businesses cannot compete with the giants, nor do they need to. What they can focus on are: operational

efficiencies, providing top-notch service, and giving customers a great experience. With that, they can command their asking

price and continue to build demand for their service or product.

THE HOW | OUR PROCESSING DISCOUNT PROGRAM

We streamline your operations, help provide a fluid customer experience, and save you money. This solution is built for

businesses that are ready to increase their profits, by offering consumers a choice.

PAY WITH CASH AND SAVE

Customers can pay with cash or cash

equivalent and pay the advertised price.

(Like pricing at the gas pump)

PAY WITH CARD

Customers pay with credit card where

their total includes a small card fee. The

merchant no longer carries the cost.

YOUR QUESTIONS... ANSWERED

A merchant's card volume and average ticket are taken into consideration by the merchant services provider to determine the fees that will be assessed to accept credit cards. Higher card volume and a low average ticket would be given a different rate percentage and swipe fee than those with low card volume and a higher average ticket.

Mobile payments and online payments through a virtual terminal also have a different fee structure depending on whether the card is present or absent during the transaction. The rate a business is charged is based on risk, but usually averages out to be between 2-4% of the transaction value.